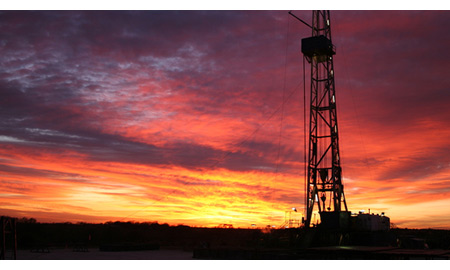

The shale gas story illustrates beautifully the futility of trying to control climate change through a carbon price. Put the price of carbon up with one hand with your climate policy and a whole bunch of very clever and determined people go to work to make money by driving it down again by fracking. It was ever thus with markets. That is why they are good at what they are good at.

What they are not good at is keeping the climate stable. An unstable climate will destabilise markets and stop them being good at what they are good at. Nick Butler’s recent FT blog believes that the shale gas explosion means that ‘those who care about the climate need to adjust their strategy.’ He does not say how, perhaps he will in a forthcoming blog.

In the meantime, those of us who care about markets will go on trying to stop the world’s fossil fuel providers from wrecking them.